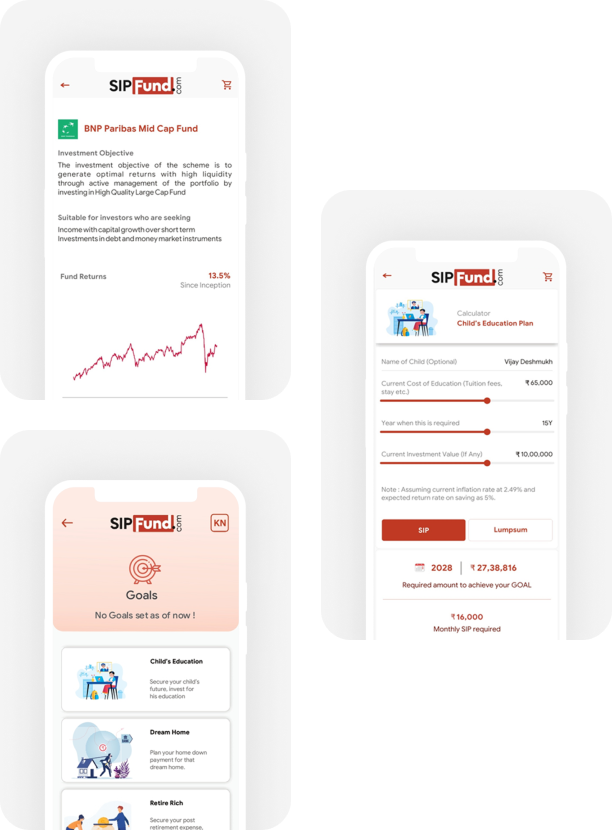

Plan Your Goals

Top Rated Funds

Complete Protection

Investment Plans

Make Own Plans

Calculator

What Do We Do?

A Platform Designed To Help You Achieve Your Financial Goals.

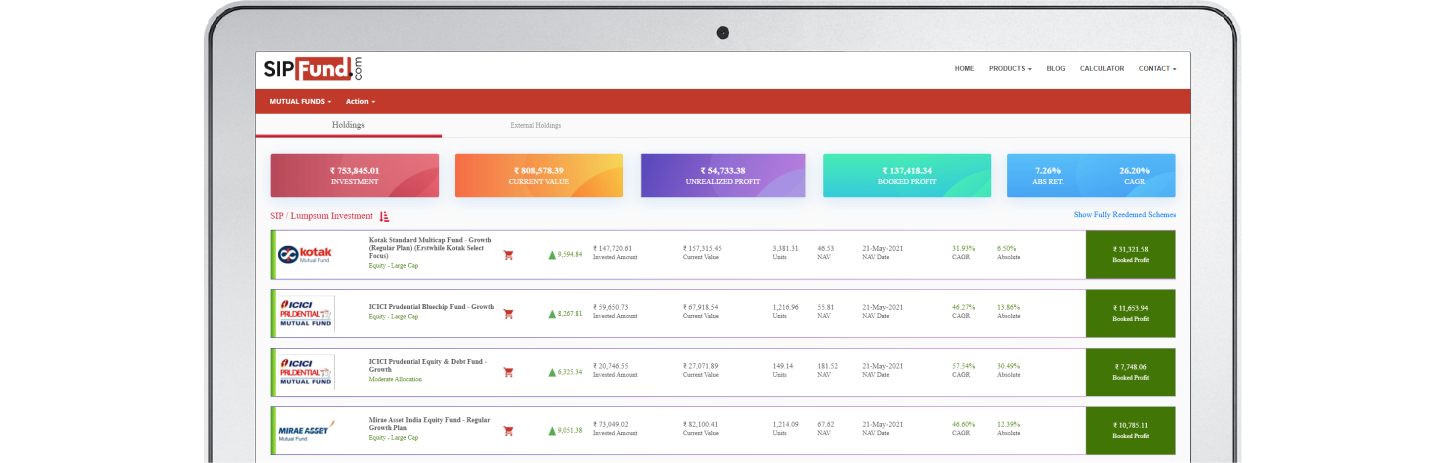

Investment Review

Funds Selection

Save Tax

Safe and Secure

Track Investment

Algorithm Based Recommendation

Have investments with many distributors? No problem! Consolidate your investments across multiple distributors from one platform. Track all your investments and get a complete view of your investments in one place with analytics. Add, view, and redeem your portfolio with all the distributors from one platform.

Latest News/Blog

Why should you invest in ELSS funds during income Tax seasons?

With the income tax season approaching, investors are actively exploring various options.....

What are the Mutual funds with Insurance Cover?

Nippon India Mutual Fund, ICICI Prudential Mutual Fund, and Birla Sun Life Mutual Fund.....

What Are Quant Funds?

Investments are handled by fund managers in a wealth and asset management firm......

TESTIMONIALS

Reviews by our Clients

SHRINIVAS MURTHY

Consultant

I have invested through SIPfund.com, their unbiased and professional advice has helped me start SIP and plan my retirement with modest sum per month. Thank You SIPfund.com

HEMANT DAHALE

MD, Hectronic India

Tasked with day to day commitment of work, I cannot look up the personal investments frequently, SIPfund.com sends me reports every month and updates me on my investment portfolio for taking right decision.

SHIVRAJ DESAI

Access Warehousing

I was not aware that SIP is such a powerful tool to invest. SIPfund.com team is excellent in offering advice and doing financial goal setting. A very refreshing approach.

DR. SUHAS KALAMBE

My experience with SIFfund.com was excellent. The professional approach and strong research shown for recommendation of funds was exemplary. I was convinced about SIP investments already but after meeting SIPfund.com, I have confirmation that I am in good hands.

Frequently Asked Questions

All your questions answered in one place.

Minimum Amount

Lockin

Flexibility

Payment Methods

Easy Withdrawal

What is the minimal amount for investing in Mutual Funds?

The minimum amount required to invest in mutual funds is very low. You can start investing in Systematic Investment Plan (SIP) with an amount of ₹ 500 only.

What is lock-in period in Mutual Funds?

A lock-in period is a specific period during which an investor is not allowed to redeem the units of the mutual fund either partially or fully.In an ELSS fund, the lock-in period is 3 years.

What is the flexibility that Mutual Funds offer?

Mutual Funds offer flexibility to investors by means of Systematic Investment Plan(SIP), Systematic Withdrawal Plan (SWP), Systematic Transfer Plan(STP), Growth Plan, Dividend Payout or Reinvestment Plans.They are also affordable as they allow investors to start investing with a little amount as low as ₹ 500.

What are the various payment methods available for an investor for making investments?

Using SIPfund.com app/portal, an investor can make purchases under the following methods.

- NET Banking

- NEFT/RTGS

- UPI

- Debit Mandate

- Cheque

Do Mutual Funds allow easy withdrawal of amount?

Both Equity and Debt Mutual Funds can be technically withdrawn as soon as fund is available for daily sale and repurchase. Of course liquidity is one of the biggest advantages of investing in Mutual Funds which is not available in many other asset classes. Amount redeemed or withdrawn will be credited to investor's bank account within 1-4 working days depending on the type of mutual funds.

Our Mutual Funds Partners